Our Services | Our Funds | The Emerging Market Debt Stars Fund

The Emerging Market Debt Stars Fund

Our Emerging Market Debt Stars Fund offers our long-term fundamental investment approach as a UCITS fund.

Our Emerging Market Debt Stars Fund seeks to preserve and create wealth by investing in a portfolio of quality emerging market businesses with the specific investment objective to:

- Generate attractive total returns from income and capital growth over the medium term.

- Maintain low overall volatility.

- Provide diversification from other major asset classes (particularly developed market equities and fixed income).

The strategy pursues an unconstrained approach with the flexibility to take advantage of idiosyncratic opportunities as and when they arise. Typical characteristics of the fund are:

- Concentrated portfolio of 30-50 holdings

- Short duration (average less than 5 years)

- Hard currency USD denominated, publicly traded liquid bonds

- Investment Grade and High Yield

- 100% corporate and quasi-sovereign issuers

- Industry and geographic diversification

- Rigorous selection process based on proprietary bottom-up issuer research, including ESG integration.

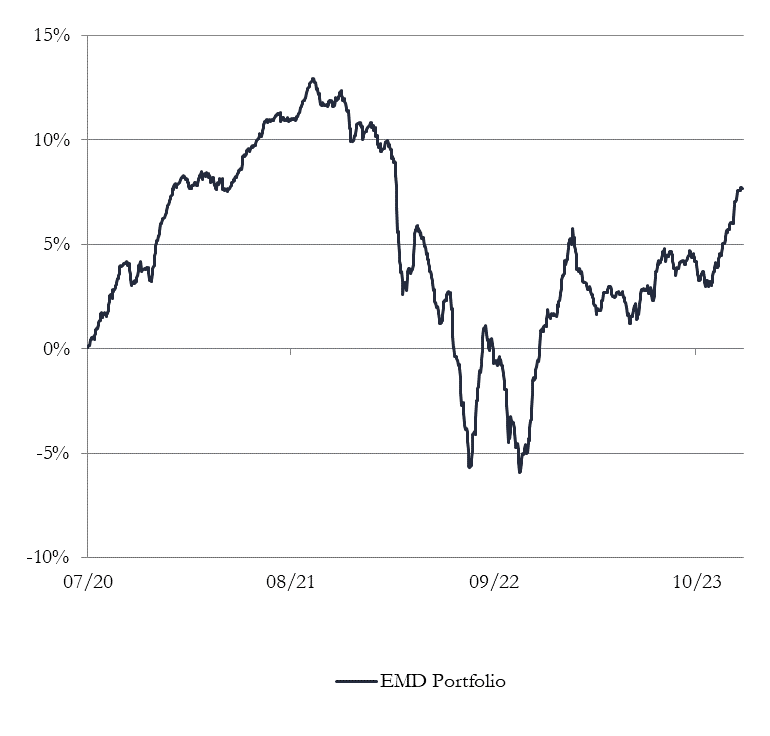

Emerging Market Debt Stars Fund Performance, A1 US

Performance is the Net Asset Value (NAV) of the Emerging Market Debt Stars Fund (“Fund”), A1 USD Share class, calculated monthly, launched on 31 January 2023. Prior to launch date performance was that of the Emerging Market Debt Stars Income strategy, based on total return (with dividends reinvested) and net of 1% fees per annum, deducted quarterly in arrears. Past performance is not a reliable indicator of future results; the value of any investment can fall as well as rise; and returns may increase or decrease as a result of currency fluctuations.

The KIIDs (Key Investor Information Docs) for each share class provides you with key investor information about the Emerging Market Debt Fund. They are not marketing material. The information is required by law to help you understand the nature and risks of investing in this fund. You must read the KIID so you can make an informed decision before deciding to invest. If you are unsure about the suitability of this fund, please consult a financial adviser. J. Stern & Co. is unable to provide such advice to you.

Your subscription is on the basis of the Prospectus of the Alpha UCITS SICAV, the umbrella fund for the Emerging Market Debt Stars Fund. The Special Section gives you information that is unique to the Emerging Market Debt Stars Fund.

To invest in the Emerging Market Debt Stars Fund, ask your financial adviser, bank, stockbroker or custodian to invest on your behalf, by sending them the KIID for the share class you wish to subscribe for. They will need to open an account, using the Account Opening Form and can then subscribe for shares on your behalf.

If you wish to invest directly, then you can open an account directly using the Account Opening Form. Once your account is opened, you can subscribe for more shares using the Subscription Form.

Should you have any questions, then contact us at debt.stars@jsternco.com

Emerging Market Debt Stars Fund – Share Class NAV Prices

| Share Class | Type | Investor | Minimum Investment | Currency | NAV Price | Valuation Date | ISIN |

| A1 | Accumulation | High Net Worth / Institutional | 1000000 | USD | 1,065.33 | 29.2.2024 | LU2511911310 |

| A1 | Accumulation | High Net Worth / Institutional | 1000000 | GBP | 1,072.90 | 29.2.2024 | LU2520334165 |

| A2 | Distribution | High Net Worth / Institutional | 1000000 | USD | 1,056.82 | 29.2.2024 | LU2652042362 |

Emerging Market Debt Stars Fund – A1 USD Share Class Monthly Performance

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | YTD | |

| 2020 | - | - | - | - | - | - | +1.6 | +1.9 | -0.4 | +0.1 | +3.1 | +1.6 | +8.2 |

| 2021 | -0.3 | +0.2 | -0.4 | +1.5 | +0.8 | +1.0 | -0.1 | +1.2 | -0.5 | +0.2 | -1.8 | +0.7 | +2.4 |

| 2022 | -0.9 | -4.1 | +0.3 | -1.7 | -1.4 | -4.8 | +0.2 | +2.5 | -4.3 | -0.7 | +5.4 | +1.5 | -8.2 |

| 2023 | +3.4 | -1.9 | -0.8 | +0.4 | -0.8 | +0.8 | +2.1 | -0.6 | +0.0 | -1.0 | +2.3 | +2.0 | +6.0 |

| 2024 | +1.6 | +1.0 | +1.1 | +3.6 |

Performance is the Net Asset Value (NAV) of the Star Multi-Asset Income Fund (“Fund”), A1 USD Share class, calculated monthly, launched on 01 October 2019. Prior to launch date performance was that of the Star Multi-Asset Income strategy, based on total return (with dividends reinvested) and net of 1% fees per annum, deducted quarterly in arrears. Past performance is not a reliable indicator of future results; the value of any investment can fall as well as rise; and returns may increase or decrease as a result of currency fluctuations. Composite Comparator is the daily performance of the following comparators: MSCI World (30%), Bloomberg Barclays Global High Yield (50%), HFR Global Hedge Fund Index (20%)

- Fact Sheets

- KIIDS

- Documentation

- Reporting

The PRIIP KIDs (Packaged Retail and Insurance Investment Product Key Information Document) for each share class provide you with key investor information about the Emerging Market Debt Stars Fund. They are not marketing material. The information is required by law to help you understand the nature and risks of investing in this fund. You must read the PRIIP so you can make an informed decision before deciding to invest. If you are unsure about the suitability of this fund, please consult a financial adviser. J. Stern & Co. is unable to provide such advice to you.