Legal Disclaimer

The Star Investment Fund (the “Fund”).

The Fund is a Luxembourg reserved alternative investment fund (fonds d’investissement alternatif réservé) organised as an investment company with variable capital (société d’investissement à capital variable) and formed as a public limited company (société anonyme) in accordance with the law of 23 July 2016 on Reserved Alternative Investment Funds (“RAIF”). The Company is an Alternative Investment Fund within the meaning of Article 1 of the Law of 12 July 2013 on alternative investment fund managers. The Fund’s alternative investment fund manager is Waystone Management Company S.A (the “AIFM”). The AIFM is authorised and regulated by the Commission de Surveillance du Secteur Financier.

Shares in the Fund are not available to be marketed to the general public and for the avoidance of doubt excludes retail. This section of the website is only directed at investors that are Well-Informed Investors within the meaning of Article 2 of the RAIF, i.e. any professional investor (as defined in the AIFM Directive 2011/61/EU). In addition, if you are in the United Kingdom, the Fund is only being promoted to investors who fall within COBS 4.12 of the FCA Handbook (as may be amended from time to time). By accessing this part of the website you confirm that you are such an investor. If you are unsure of your categorisation, you should seek professional advice.

The Fund is not registered nor does it intend to register under the US Investment Company Act 1940, nor has its shares been registered under the US Securities Act 1933 and may therefore not be offered, sold, transferred or delivered directly or indirectly in the United States or to, or for the account or benefit of or directed to persons who are residents or citizens of the United States (including persons who are “US Persons” under US federal income tax or securities laws) or who are located in any country, state or jurisdiction where the Fund is not authorised for distribution or in which the dissemination of information regarding the Fund on the internet is not permitted.

You understand that it is your responsibility as the investor, or your advisor, to ensure that the offering and sale of Fund shares complies with the relevant national and/or local law. You should inform yourself as to the applicable legal requirements, exchange control regulations and taxes in the countries of citizenship, residence or domicile. If you are in doubt about the suitability of this Fund you should seek advice from your investment advisor.

You understand that the information on this website does not constitute an offer or solicitation to subscribe for or acquire any shares in the Fund in any jurisdiction, nor does this information constitute as advice, a recommendation or an expression of our view as to whether a particular security or financial instrument is suitable for any investor accessing the website or meets their financial or any other objectives.

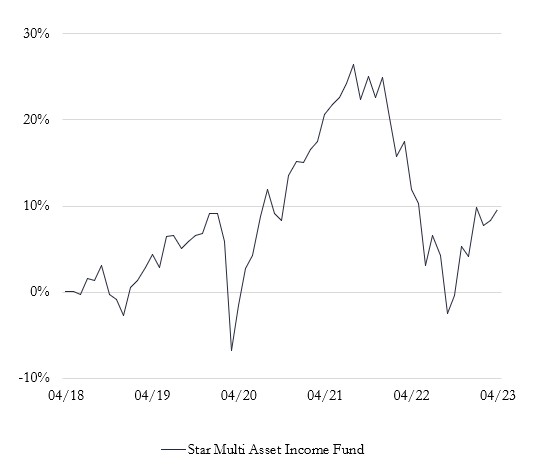

The value of the shares of the Fund may fall as well as rise and an investor may not get back the amount initially invested in the Fund. Any income that is derived from the investment contemplated herein may fluctuate. If you are considering investing in this Fund, make sure you read all the available information on this website and related Fund documentation for specific risks, ensuring you understand and accept the risk that you may lose some or all of your investments. If you are in any doubt, please speak to your investment advisor to ensure you fully understand the nature of the investment and the risks involved. You may not have access to the Financial Ombudsman Service and Financial Services Compensation Scheme if you have a complaint and should speak to your advisor if you are concerned.